“Companies across all sectors of the construction value chain are using methods such as internal carbon-reduction targets, development of innovative green products, advocacy for sustainability standards, and integration into the circular economy to embed sustainability into their operations and products. While the momentum toward sustainability is ubiquitous across the industry, it manifests differently in each sector along the value chain.”

IFC World Bank Group CPLC, Construction Industry Value Chain, 2018

Smart, connected technologies are having a profound effect on the construction industry. As leading industry analysts note, construction is undergoing a digital transformation. At the same time, the construction sector is becoming far more accountable for its ecological impact and contributions to global emissions.

Today’s digital advancements allow for the automation of sustainable construction innovations and greener, more eco-friendly building materials. Sustainable advances couldn’t come at a better time for an industry that must increasingly manage climate risks and higher prices in a post-pandemic world that is currently facing hyperinflation.

As the above-referenced 2018 IFC & World Bank report goes on to note, construction businesses everywhere are “facing pressure from investors, banks, regulators, contracting authorities, and consumers to mitigate their climate risk and find new solutions to reduce their carbon footprint.”

Though the construction sector has, until now, lagged behind other industries in terms of digital transformation and sustainability, they’re on the verge of catching up. Recent technological advances in sustainable innovation bring builders far greater savings than traditional construction methods, lowering risks and energy consumption along the entire value chain.

According to Construct360’s Bashar Jabban, sustainable innovation is nothing less than “the future of the value chain.” Below is a brief overview of how the value chain in construction works and how sustainable innovation is already impacting the construction industries of today and tomorrow.

The Value Chain in Construction

A high-level overview of the traditional construction sector:

.jpg?width=673&name=High-level%20overview%20of%20the%20traditional%20construction%20sector%20(Source%20-%20BPIE).jpg)

Source: Buildings Performance Institute of Europe (BPIE); January 2016 study, ‘Driving Transformational Change in the Construction Value Chain.’

In construction and development, the value chain stretches from supplying raw materials through the construction project and long past the final market sale to post-sale, regular building maintenance. As a result, the construction value chain can span borders and involve post-construction services. Because the construction sector has many moving parts - architects, engineers, contractors, lumber yards, regional authorities, and more agents - establishing a transparent value chain for construction has remained a challenge until now.

To quantify and define this tricky terrain, the Buildings Performance Institute of Europe (BPIE) launched a study examining the value chain in traditional and modern construction methods. In BIPE’s 2016 report, Driving Transformational Change in the Construction Value Chain, they organized and defined the actors and processes involved in every stage of construction.

The building value chain - interactions between actors in the process of value supply:

.jpg?width=671&name=The%20building%20value%20chain%20-%20interactions%20between%20actors%20in%20the%20process%20of%20value%20supply%20(Source%20-%20BPIE).jpg)

Source: Buildings Performance Institute of Europe (BPIE); January 2016 study, ‘Driving Transformational Change in the Construction Value Chain.’

The entire construction value chain can be likened to the full life cycle of residential and commercial buildings and their infrastructure. Though offsite prefabrication is prioritized, onsite services can range from general services to indirect sectors to public authorities.

In that same 2016 report, BIPE divides the construction life cycle into four distinct phases:

01. The Preparation & Design Phase (prefabrication, sustainable designs, and offsite elements).

02. The Execution Phase (comprising the bulk of onsite construction and modular assembly).

03. The User Phase (when the end-user or owner takes ownership onsite).

04. The Disposal & Recycle Phase (wherein maintenance and ecological issues are routinized).

In defining this value chain for modern construction, BIPE underscored three core construction competencies, represented by three gears: Building Services, Building Supply, and Onsite Execution. This is where the bulk of design and construction takes place. This is also the area where construction has, until now, exerted such a massive impact on global carbon emissions.

Charting operational variables such as global supply and demand factors as well as energy-saving potentials, BIPE attempted to identify ‘megatrends’ across construction. In addition to the prevalence of ‘decarbonization’ as a major sustainability initiative: BIPE identified five emerging megatrends in construction as digitization, mass customization, servitization, resource efficiency and increased circularity.

Disruptive, connected technologies allow for sustainable improvements along the value chain, improving circularity. These ecological improvements and energy efficiencies will add up. Better energy performance for buildings translates directly into lesser financial costs, reinforcing greater construction sustainability. The future of construction is indeed green.

What Is Sustainable Innovation, and Why Is It Important

Green buildings and energy-saving construction techniques are just the beginning of sustainable innovations in modern construction. Hoping to transition to a low-carbon economy by 2050, the BIPE authors, in their 2016 report, wrote that they expected public authorities in Europe to lead people by their good example. Since then, the real need for energy savings and carbon efficiencies has only grown. In 2021, McKinsey & Co. examined construction’s carbon impact.

“Global GHG emissions have risen rapidly over the past 100 years, and the planet continues to warm. The effects of climate change are already apparent: major flooding events, extreme heat, and agricultural degradation are on the rise, resulting in well-documented environmental consequences. From a business perspective, infrastructure, supply chains, food systems, asset prices, land and labor productivity, and economic growth itself are increasingly at risk... Nevertheless, tackling emissions will be challenging. Providing incentives for players across the value chain to take joint action is a necessary part of this process. The construction ecosystem is in the midst of a transition that is reshaping all parts of the industry.”

McKinsey, Call for Action: Seizing the Decarbonization Opportunity in Construction, July 2021

Since construction plays a dominant role globally, traditional construction’s environmental costs have a significant impact. In terms of recorded GHG emissions, McKinsey & Co. found that internationally, “across the value chain, the construction ecosystem accounts for approximately 25% of global GHG emissions.” The energy-intensive cement creation process and global steel production are the most significant contributing factors to these emissions.

It becomes critical to curb the construction ecosystem’s carbon output when emissions are expected to continue rising over the next 30 years. To reduce construction’s carbon footprint while continuing to meet the needs of increased urbanization and a growing population isn’t entirely straightforward. However, if left unaddressed, the ecological problems will mount.

A closer look at the construction efficiencies that embrace sustainability across the value chain, from design through construction, follows.

What Is A Sustainable Supply Chain

This past November of 2021, McKinsey & Co. published a report on the operational challenges facing typical construction value chains operating under rapidly changing markets. Unexpected challenges have continued, even after the worst of the COVID-19 pandemic and climate-related anomalies. The more recent ‘supply and demand’ bottleneck issues, rising fuel costs, and hyperinflation all underscore the need for sustainability in the construction value chain.

“Value-chain resilience is the ability to recover quickly and gracefully from challenges. It can be achieved by improving end-to-end processes (to ensure decisions are considered within a broader context), deploying asset capacities across the value chain (such as adding warehouses and trucks as necessary), and deploying planning capabilities that incorporate these uncertainties (a single source of truth and AI-powered optimization models). Over the past year or so, the COVID-19 crisis has highlighted the critical importance of the ability to react to unforeseen events effectively while sacrificing as little value as possible.”

McKinsey, Building Value-Chain Resilience with AI, November 2021

The same McKinsey & Co. report underscores the analytical capacity of AI to help resolve complexities and improve efficiencies all along the value chain. To implement AI value-chain analytics successfully for integrated planning, simulation, and optimization, McKinsey recommends that developers take the following steps:

- Identify potential constraints in the value chain and how they shift over time.

- Determine the optimal value-chain setup under variable conditions.

- Select the best way to schedule capacity across the end-to-end value chain.

- Adopt the best value-maximizing production strategy and set up the value chain to support this strategy.

- Identify which value chains are exposed to risk due to various factors such as a health crisis or complex geographies.

McKinsey & Co. recommends that industries employ AI to provide real-time supply-chain monitoring and thus enhance their value-chain resilience. Since every value chain constantly changes, enhanced monitoring with AI decision-making skills can significantly assist value-chain resilience, improving and optimizing sustainable construction innovation.

The Changing Face of the Construction Value Chain

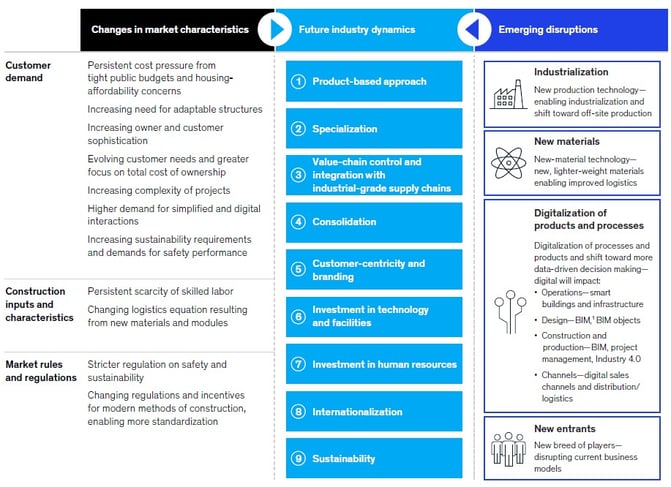

Changing characteristics and emerging disruptions will drive change in the industry and transform ways of working:

Source: McKinsey; June 2020 report, The Next Normal in Construction

‘The Next Normal in Construction,’ published in 2020 by McKinsey & Co., reports on modern construction’s changes and pressures. Homeowners and developers face cost pressures and affordability concerns throughout the global housing market. Recent years have also seen a marked scarcity of skilled construction labor alongside stricter worksite safety and sustainability regulations, including calls for reduced carbon emissions.

The smart construction transformation has focused on energy and cost savings, automated technologies, and AI analytics for ‘connected construction’ in response to market pressures. Modern Methods of Construction (MMC) is the most prominent among current strategies. Prefabrication, offsite modularization, and Design for Manufacturing and Assembly (DfMA) are among the most prevalent. In addition, using the P-DfMA design approach for construction, standardization can be maximized, resulting in greater sustainability and cost savings.

In that same report documenting recent industrial construction trends and sustainable technologies, McKinsey & Co. noted the following’ nine industry shifts’ that are currently underway in construction:

01. A product-based approach. This standardizes homes and construction modules as ‘products.’ This approach allows for far more simple onsite assembly by allowing greater offsite production.

02. Specialization. Builders should specialize in luxury housing, multistory residential buildings, hospitals, processing plants, etc., to build a niche competitive advantage.

03. Value-chain control and integration with industrial-grade supply chains. Companies will move to own or control important activities along the construction value chain, such as design and engineering, supply-chain management, select-component manufacturing, and onsite assembly.

04. Consolidation. The demand for digitalization and specialization across the industry will require far larger scaling, leading to the consolidation of construction into an industrialized sector.

05. Customer-centricity and branding will result in construction firms that can compete in product and service quality, value, timelines for delivery, reliability, warranties, and more.

06. Technology and facilities will be far greater since offsite factories require significant investments in plants, manufacturing machinery, management systems, and robotics. Investments in modern surveying equipment are likely to include laser scanners and drones.

07. Investment in human resources. Advanced technology continues automating risk management and project management, decreasing the need for personnel in those areas. Instead, more significant investments should be made in value-chain management and the digital talent needed for growth.

08. Internationalization refers to globalization within construction. Reduced barriers and greater global standardization should allow for more in-demand infrastructure projects worldwide.

09. Sustainability, as a driving factor globally, is transforming construction. As a result, businesses will need to examine their environmental impact, track their supply chains, and evaluate sourced materials. This, in turn, will make construction safer and far more sustainable.

Sustainable construction methods, eco-friendly buildings, energy-saving construction techniques, and green building materials all transform construction. Among the smart, connected innovations most affecting sustainable innovation is the digital integration of the entire construction supply-chain ecosystem.

Bringing in Sustainable Construction Materials

Sustainable innovation in construction is just beginning to make an impact. Green buildings resulting from sustainable innovations are producing far more significant cost savings. AI and digital technology provide value-driven solutions and improved eco-friendly designs. Sustainable innovation in construction now also includes re-thinking raw materials.

The construction industry has seen significant sustainability improvements in materials such as wood and asphalt, resulting in far greater efficiency. The improved raw materials include eco-sustainable asphalt, fire-resistant timbers, geosynthetics, improved insulation, optimized building automation, self-healing materials, renewable energy sources, and other innovations.

At each step along the value chain, sustainable construction innovations help reduce energy consumption and costs while improving the efficiency and lifespan of the built structures.

The Pros and Cons of Sustainable Construction

The digital transformation occurring within construction today spans from AI decision-making analytics to integrated design in the construction value chain to sustainable construction-waste management. Recent digital advancements include site-management software and technology that help streamline operational processes, reduce risks, and automate project management tasks.

The range of cost-saving and time-saving efficiencies in emerging construction technologies should give construction companies far greater control and autonomy. However, these improvements will also come at a great price. Industry consolidation is expected, leaving those who are less prepared behind. In addition, major disruptions along the construction sector’s value chain will continue to displace traditional construction methods in favor of more industrialized, sustainable options.

In fact, McKinsey, in their above-noted June 2020 report, wrote: “There is reason to believe that a winner-take-most dynamic will emerge, and companies that fail to adjust fast enough risk seeing market shares and margins erode until they eventually go out of business.”

Successful implementation of smart, sustainable construction technology is vital.

Sustainable Development: Challenges, Costs, and Savings

With the early adoption of sustainable innovation, the prospects for the construction industry look bright. Global efforts to reduce CO2 emissions in construction and its entire value chain continue. Quite prevalent amid global challenges and climate goals are decarbonization initiatives. McKinsey & Co., in their July of 2021 report ‘Call for Action: Seizing the Decarbonization Opportunity in Construction,’ noted the following about construction’s emissions footprint.

“The construction ecosystem is driving global emissions. GHG emissions from the construction ecosystem are mainly driven by two components: raw-material processing for buildings and infrastructure (about 30 percent of total construction emissions per year, largely cement and steel) and buildings operations (about 70 percent). Given typical asset lifetimes of 30 to 130 years, we cannot wait to replace products at the end of their life cycle if we are to meet climate-change-mitigation targets by 2050.”

McKinsey, Call for Action: Seizing the Decarbonization Opportunity in Construction, July 2021

In the UK, ‘Construct Zero’ has become a significant sustainability priority initiative for construction. Proposed by the UK Construction Leadership Council (CLC), they are working to reduce CO2 emissions in both the transportation and construction sectors to achieve net-zero emissions by 2025. To do so, they foresee the following industry needs:

- Retrofitting existing buildings with improved energy-efficiency measures.

- Offering low-carbon heating solutions for buildings.

- Enhanced energy performance in buildings through improved efficiency standards.

- Carbon measurement for construction activity to monitor, reduce, and remove carbon.

- Support of low-carbon innovations in terms of materials and manufacturing processes.

- Construction designs to phase out carbon and offer rewards for moving toward a circular economy.

Sustainable construction measures will help save money and climate health through improved efficiencies. In meeting the zero-emission standards proposed by the CLC, they believe that the following cost savings would result:

- 33% reduction in construction costs

- 50% reduction in program costs

- 50% reduction in the trade gap

- 50% reduction in carbon emissions.

Such immense cost savings add up. As a result, the CLC hopes that the UK’s “world-class” construction sector, which comprises 8% of the UK GDP and 10% of its workforce, will lead the world by example in terms of reaching zero carbon emission targets and other sustainability measures.

The Future: Greater Value Chain Sustainability in Construction

Green designs, automated performance efficiency for buildings, and other sustainability solutions in construction will have considerable impacts for years to come. Not just in terms of the substantial cost savings from improved energy efficiency in buildings but also from better outcomes regarding worker health and safety, reduced operational risk, standardized construction, improved building materials, and longer building lifespans.

Get the expertise you need to understand the requirements for successfully developing sustainable construction methods and applying correct measurements for your team. Contact Bashar for an initial consultation on implementing sustainable innovation for your business all along your value chain.

Sustainability is one of the change catalysts and enablers in the Construct360 practical approach to digital transformation in construction and real estate development companies.